Notwithstanding continued economic uncertainty, Lodging Analytics Research & Consulting (LARC) remains encouraged by the U.S. lodging industry’s recent performance and our outlook for 2023 and beyond which is only modestly altered.

Macro-economic uncertainty has increased in recent months as several regional banks dissolved and fears of contagion across the financial markets have been in focus. Our assumption is that, with the assistance of regulators, the financial sector eliminated any potential systemic risk across the financial system, however bank lending parameters have tightened, which will lead to a broadbased decline in credit availability and meaningfully slow economic growth through 2024. Layer on the implications from approaching a U.S. debt limit breach due to the inability to reach a debt ceiling increase agreement in Washington, D.C. and there are plenty of reasons to be cautious about near-term economic growth.

As a result of these factors, consensus now expects the Federal Reserve Board’s (Fed) rate increase cycle to have come to an end. Whether the U.S. enters a recession or not may be a matter of semantics, but regardless, we expect economic growth to be limited through 2024. Moody’s Analytics does not expect a recession in their base case currently, but forecasts just 1.6% Real GDP growth in 2023 and 1.7% in 2024.

Despite a challenging quarter for macro-economic growth (U.S. GDP was up just 1.1%), 1Q-2023 U.S. RevPAR rose 17% on a year-over-year basis, driven by a 10% increase in ADR and a 6% increase in occupancy. Additionally, 1Q-2023 RevPAR was 13% above 2019 levels, driven by ADR that was 17% above 2019 levels.

Regardless of the RevPAR strength experienced in the first quarter, growth in lodging fundamentals will noticeably slow in 2Q-2023, driven by a confluence of the following factors:

- The erosion of soft year-over-year Omicronvariant-related comparisons.

- More difficult year-over-year leisure comparisons.

- Declining business investment spending in 1Q2023, which is likely to impact the pace of corporate travel recovery.

- Sluggish economic growth.

Moving forward, industry growth will need to be fueled by the corporate and group segments. While declining economic activity has not had a meaningful impact on the lodging recovery to date, as the cycle shifts from recovery into expansion, economic activity will become a primary driver of performance. With the outlook for economic expansion remaining muted, it is our view that growth in fundamentals will substantially slow through the remainder of 2023 and into 2024 and 2025.

There are several silver linings to our outlook for the U.S. lodging industry. While the corporate recovery will be somewhat dependent on the return to the office, we expect office utilization to gradually improve through 2023. As corporate demand is still well below pre-pandemic levels, soft economic growth is unlikely to translate into a pullback in corporate transient demand. Rather, it will simply slow the pace of recovery, which still points to positive growth.

Furthermore, group trends appear robust, helping generate a base level of demand that will further support pricing power. Nationally, we estimate that the convention center booking pace is up 17% on a year-over-year basis in 2023. However, much of that strength was tied to 1Q2023 and as we look further out, the 2024 convention booking pace is down 11% year-over-year.

Our economic forecast from Moody’s Analytics incorporates the following key national assumptions:

- The Fed will pause rate increases until cuts begin in 2024.

- Congress and the Biden Administration will avoid a debt-limit breach.

- Inflation will drop to under 3% by year-end2023.

- U.S. GDP will increase 1.6% in 2Q-2023 and increase 1.6% for the full year.

We expect RevPAR growth to meaningfully slow in 2Q2023, but modestly reaccelerate in the second half of the year. Overall, we expect U.S. RevPAR to be up 6.6% this year, followed by 3.9% in 2024. Should any of the above core macroeconomic assumptions meaningfully change, it could have a substantial impact on our U.S. lodging industry forecast.

Our detailed, transparent process has continually led to the most accurate forecasts for the U.S. industry and for the specific markets we follow. During my January 2023 ALIS presentation I forecasted 2023 U.S. RevPAR growth of 6.8% (which remains close to our current 6.6% RevPAR growth forecast) roughly double the forecasts of my fellow panelists. Since then, the industry’s forecasts have continued to move toward ours. While there is a lot of 2023 left to play out and a tremendous amount of economic uncertainty, we remain confident in our process that yielded, not only the most accurate forecasts during the past several years, but one that was very much out of consensus to start this year and now appears more and more accurate with each passing day.

We continue to expect there to be U.S. lodging markets that materially outperform as well as those that underperform national averages. As the lodging industry shifts into the next stage of the cycle, we generally believe leisure markets will begin to cool, while inbound international demand should drive stronger growth to gateway markets , however, they will also take the longest to fully recover to pre-pandemic levels.

We also expect hotel capitalization rates to stabilize, financing costs to moderate and transaction volumes to rebound. However, moving forward, expense pressures will become a substantial factor in identifying markets that are winners and those that are losers. Wage growth and margin pressures materially shape our views on markets that are best and worst for investment today.

We believe the best business decisions are based on the best information available at the time of making that decision. We take that approach with our forecasts, using the best available information to provide the most likely outcome. As such, we believe transparency surrounding forecasting is critical to the lodging industry.

LARC’s industry-leading market intelligence referred to throughout this document can help all industry participants navigate the current environment and position themselves for success as the industry navigates these uncertain times. Please contact us directly to learn more about our services and products or if there is any other way we may be able to better serve you.

LARC’s Industry Outlook

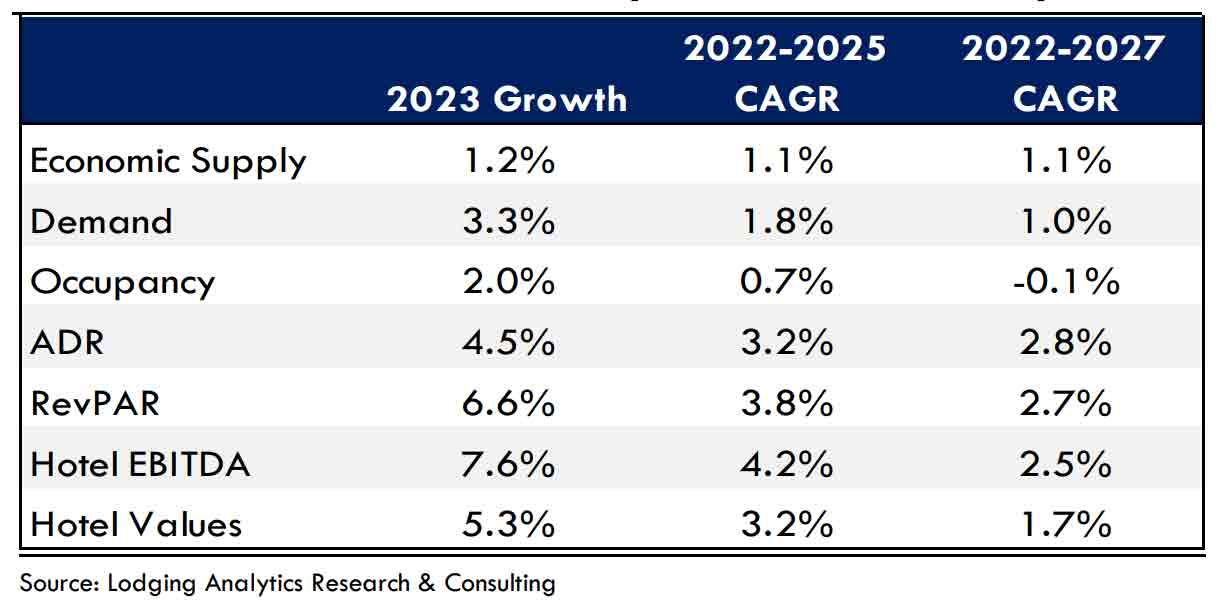

Currently, Lodging Analytics Research & Consulting (LARC) expects U.S. RevPAR to increase by 6.6% to $99.45 in 2023, resulting in an annual RevPAR that is 15% above 2019 levels. LARC anticipates ADR to rise by 4.5% this year to $155.70, or 19% above 2019 levels, while occupancy will increase 2.0% to 63.9%.

Despite challenging capital markets, LARC anticipates 2023 U.S. Hotel EBITDA to grow by 8% and Hotel Values to increase 5%. LARC believes 2022 Hotel Values were merely 1% below 2019 levels and that both Hotel Values and Hotel EBITDA will reach 2019 levels in 2023. June 2023 U.S.

Hotel Industry Forecast Summary

LARC’s U.S. RevPAR model has an R-squared of 99.6% with a standard error of 4.7%, back-tested to 2000. LARC’s U.S. Cap Rate model has an R-squared of 98.4% with a standard error of 26 bps, back-tested to 2005.

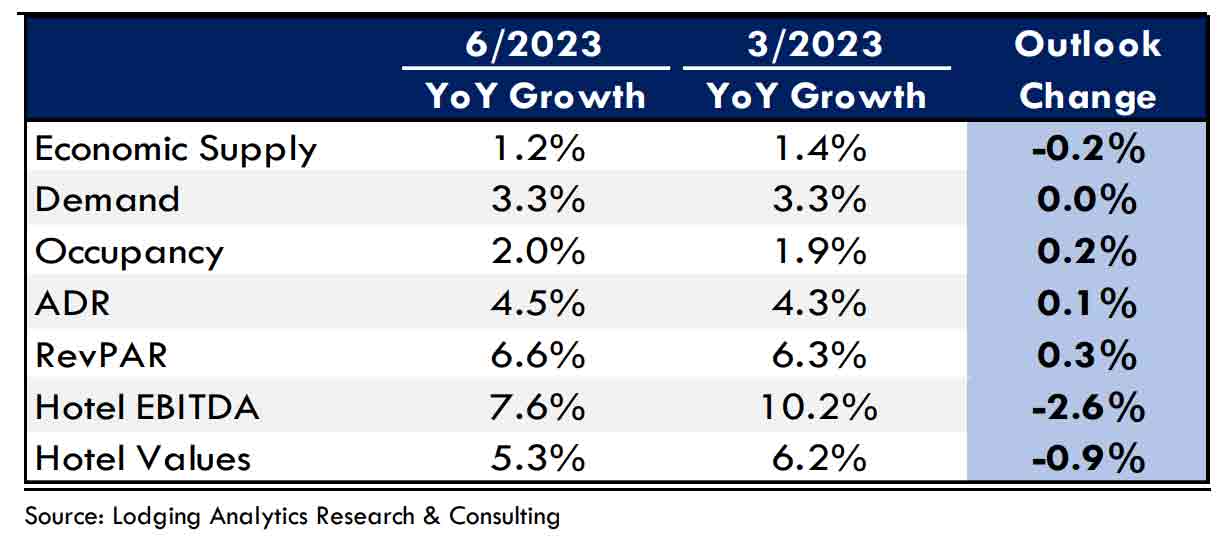

The following table illustrates a summary of LARC’s current U.S. Hotel Industry Outlook in contrast to last quarter’s outlook. Ultimately, our 2023 view for supply moderated slightly, driving our occupancy outlook slightly higher. Our outlook for ADR also increased slightly and combined with our occupancy forecast improvement, drives a modest 0.3% increase to our 2023 RevPAR outlook. However, as our outlook for expense growth increased, Hotel EBITDA growth slowed, driving Hotel Value slightly lower.

2023 U.S. Hotel Industry Forecast: June 2023 Edition vs. March 2023 Edition

Market Outlooks

Below is a list of the best and worst performing markets based on our forecasts. Similar to LARC’s U.S. forecast, our market level forecasts are built entirely on multivariable regression models with high historical accuracy.

More detail on our market outlooks can be found in LARC’s Market Intelligence Reports. Please contact us if you are interested in purchasing any of LARC’s offerings.

2023 (relative to 2019)

Top Markets for RevPAR Growth: Palm Beach, Tampa, Phoenix, Puerto Rico and Mobile

Bottom Markets for RevPAR Growth: San Francisco, San Jose, Portland, Minneapolis and Columbus

2023 (year-over-year)

Top Markets for RevPAR Growth: San Francisco, Washington, D.C., San Jose, Houston, and Honolulu

Bottom Markets for RevPAR Growth: Miami, Omaha, Puerto Rico, Mobile and New Orleans

2019 – 2027 Outlook

Top Markets for RevPAR Growth: Palm Beach, Mobile, Puerto Rico, Las Vegas and Memphis

Bottom Markets for RevPAR Growth: San Francisco, San Jose, Kansas City, Cincinnati and Louisville

Top Markets for Value Change: Puerto Rico, Tampa, Nashville, Las Vegas and Miami

Bottom Markets for Value Change: San Francisco, Portland, Boston, Chicago and St. Louis

Ryan Meliker

President

Lodging Analytics Research & Consulting, Inc