As of year-end 2022, the average hotel in CBRE’s Trends in the Hotel Industry survey sample had surpassed its 2018 total revenue figure by 1.5 percent. This was achieved even though the average hotel had rented 8.2 percent fewer room nights in 2022 than it did in 2018. The revenue increase was largely due to continued improvement in ADR and revenue from other sources. The strategy to drive revenue from other sources was in direct response to the reduced number of occupied rooms and the increased cost of conducting business. One of these ancillary revenue sources was spa services.

To assess the impact of hotel spa departments on recent hotel operations, we analyzed the performance of 139 U.S. hotels that operate a spa and participated in CBRE’s Trends survey each year from 2018 through 2022. In 2022, these 139 hotels averaged 63.5 percent occupancy, along with a $426.78 ADR. The sample consisted of 83 properties located in resort markets and 56 operating in urban areas. Excluded from this analysis were hotels that leased out their spa operations to third-party operators (i.e., an operator outside of the hotel management company).

Revenue

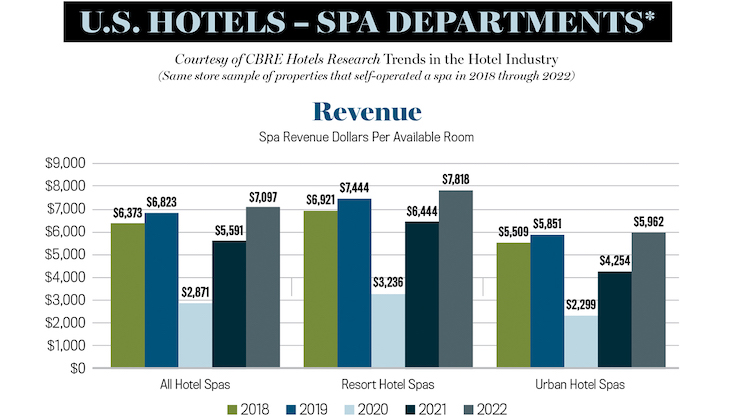

In 2022, the hotels in our research sample averaged $7,097 per available room (PAR) in spa revenue, which includes revenue from all spa services (e.g., massages, body treatments, salon services, and retail sales). The $7,097 PAR figure is 12.6 percent greater than the spa revenue earned in 2018. Hotel spas in resort areas achieved revenue growth of 14.2 percent from 2018 through 2022, while properties in urban locations experienced spa revenue increases of 9.1 percent.

While the revenue PAR growth rates are impressive, we noted even more dramatic increases in spa revenue on a dollar per occupied room (POR) basis. Over the past four years, the average hotel in our sample saw its spa revenue POR increase by 27.7 percent from $23.97 in 2018 to $30.61 in 2022. The POR increase was greater at resort hotel spas (28.5 percent) versus urban hotel spas (25.8 percent) due, in part, to the nature of the spa experience in resorts versus urban. Generally, spa services in resort locations are impacted by marketing to a captive guest who is on vacation, while urban spa locations tend to target market-specific services to a demographic who are using the spa and its services for a very specific reason or purpose.

Since the hotels in our sample are still accommodating fewer guests than in 2018, we believe the greater increase in spa revenue on a POR basis (compared to PAR) is indicative of a few factors:

- A greater percentage of hotel guests using spa services

- Increases in the price of spa services

- Increases in the length of stay at resort hotels

- Increases in the use of hotel spas by local patrons, especially at urban properties

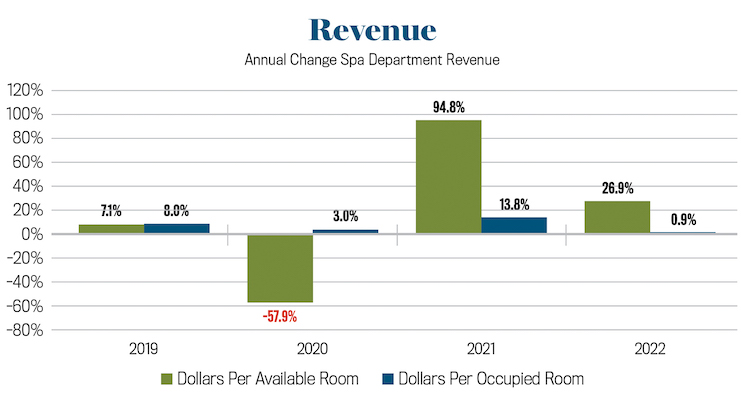

These trends were most evident in 2020, when hotel spa revenue declined on a PAR basis by 57.9 percent but increased on a POR basis by 3 percent. Despite the growth in revenues on a POR and PAR basis since 2018, spa revenues on average represented less of a percent of total hotel revenue in 2022 (3.7 percent) than they did in 2018 (3.8 percent). This is fully attributable to the ability of spa hotels to achieve significant gains in ADR during this time. It should be noted that the rate premiums were achieved at the resort hotels with spas, as opposed to the urban spa hotels. From 2018 to 2022, the resort hotels with spas achieved a 9.3 percent compound annual growth rate (CAGR) in ADR, while spa revenues POR grew by a CAGR of 6.5 percent. For urban spa hotels, ADR annual growth was 5.4 percent while spa revenue POR growth was 5.9 percent, providing further evidence of the influence of local patronage at urban hotel spas.

Expenses and Profits

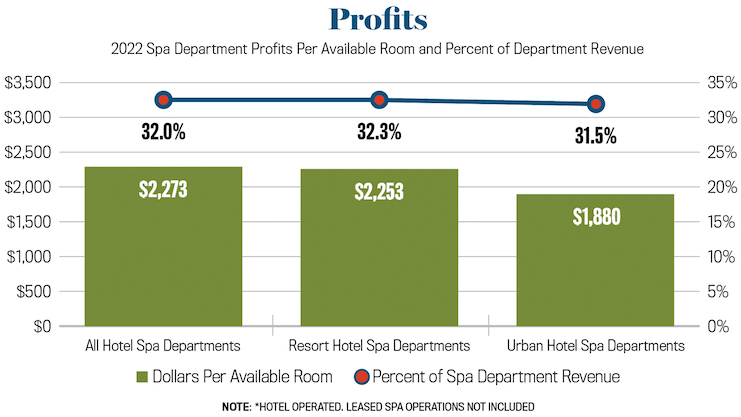

While hotel spa revenues PAR were increasing at a CAGR of 2.7 percent from 2018 to 2022, spa department expenses grew by just 1.8 percent. Labor costs, which made up 74 percent of all expenses at a typical hotel spa in 2022, increased the most at 2.3 percent CAGR. Conversely, we saw a 1.2 percent CAGR decline in the cost of goods sold within spa departments, due to a decline in the volume of retail sales.

Because of scheduling and labor challenges, spas typically rely on contract/leased labor to fill the positions of massage, body treatment, and salon technicians. To offset the rise in salaries and wages, as well as the volatile business volumes, we have seen an even greater use of contract/leased labor since the pandemic. In 2018, contract/leased labor costs comprised 2.1 percent of total spa department salaries and wages, but this figure rose to 11.8 percent in 2022. The use of contract/leased labor appears to be greater at urban hotel spas compared to resort hotel spas. With revenues increasing at a faster pace than expenses, not only have spa department profit margins increased, but so have spa department profit dollars. From 2018 to 2022, spa department profits have increased by 23.5 percent on average, with profit growth for resort spas (23.7 percent) slightly greater than the growth of spa profits at urban hotels (23.2 percent). Spa profitability has improved during the past several years, likely due to improved operational oversight and increased revenue. While spa expenses have been increasing, the cost for spa services for consumers has also increased, and we expect this trend to continue. We also expect profitability to be maintained and possibly increase during the near term.

Well-executed spa programs add not only to the guest experience, but also to the overall profitability of the operation of the hotel. In some cases, guests are making decisions on where to stay based on whether the hotel or resort includes a spa. In fact, some resorts are becoming well-known for their spas and recreational activities, and target guests that are specifically seeking these amenities. During the near term, hotel operations that include spa services are expected to perform well and possibly expand their services.